knoxville tn state sales tax

The local tax rate may not be higher than 275 and must be a multiple of 25. The County sales tax rate is.

House located at 165 Old State Rd Knoxville TN 37914 sold for 43800 on Mar 31 2014.

. For example if you buy a car for 20000 then youll pay 1400 in state. Hendersonville TN Sales Tax Rate. Exact tax amount may vary for different items.

This amount is never to exceed 3600. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Manager State and Local Tax - Sales and Use Compliance.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. The Knoxville sales tax rate is. The sales tax is comprised of two parts a state.

This is the total of state and county sales tax rates. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in. This is the total of state county and city sales tax rates.

Last item for navigation. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in. Last item for navigation.

The average cumulative sales tax rate in Knoxville Tennessee is 925. Germantown TN Sales Tax Rate. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and.

Add Business Partner Affidavit PDF Amusement Tax Report PDF. The local sales tax rate and use. As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price.

State Sales Tax is 7 of purchase price less total value of trade in. TN Sales Tax Rate. 400 Main St Room 453.

The Tennessee sales tax rate is currently. Job in Knoxville - Knox County - TN Tennessee - USA 37921. Local Sales Tax is 225 of the first 1600.

Tax Sale 10 Properties PDF Summary of Tax Sale Process and. Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that. We will contact businesses submitting the application by.

3br2ba ranch built in 2004. What is the sales tax rate in Knox County. 2022 Tennessee state sales tax.

All local jurisdictions in Tennessee have a local sales and use tax rate. Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 if purchased in Tennessee Minus credit for 1518 FL sales tax paid. 4 rows Knoxville TN Sales Tax Rate.

3 beds 2 baths 1140 sq. 925 7 state 225 local City Property Tax Rate. 15540 per 100 assessed value.

3 Page 1099-K Filing Requirement 29. 21556 per 100 assessed value County Property Tax Rate. 400 Main St Room 453.

Current Sales Tax Rate. The minimum combined 2022 sales tax rate for Knox County Tennessee is. The current total local sales.

Purchases in excess of 1600 an.

Proof Of Funds Letter Letter Templates Lettering Letter Sample

Knoxville Neighborhood Appeals High Property Appraisals Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

All You Need To Know When Moving To Knoxville Tn College Hunks Hauling Junk Moving

16 Best Knoxville Tax Services Expertise Com

Tennessee Tax Free Shopping Weekend 2022

The Online Highway Guide Highway Signs Chicago Pershing

Cheap Flights From New York To Knoxville From 57 Nyc Tys Kayak

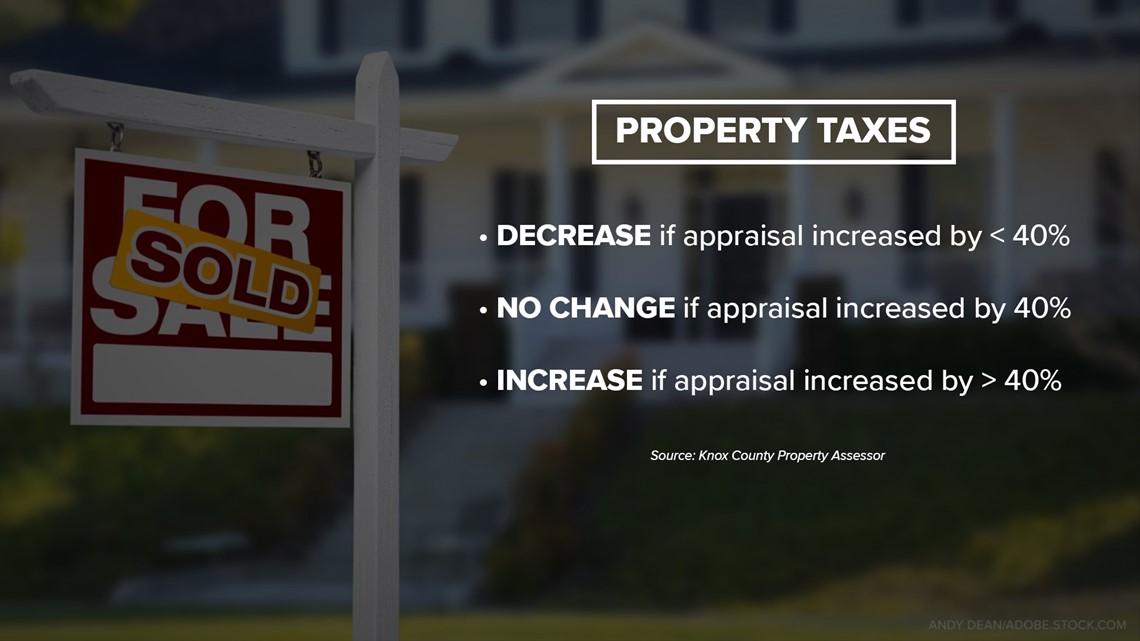

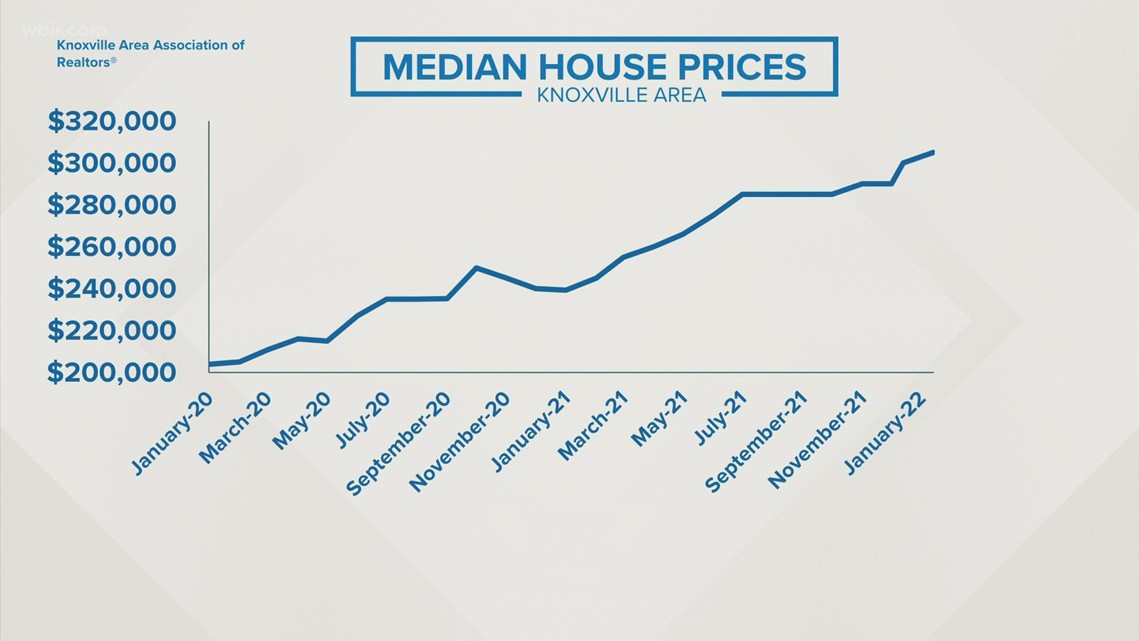

Property Tax And Pay Increase Approved By Knoxville City Council Wbir Com

Homeowners Appeal Property Value Reassessments In Knox Co After Learning They Rose Significantly Wbir Com

Free 16 Boutique Business Plan Templates In Pdf Ms Word Within Clothing Store Busin Business Plan Template Free Business Plan Template Business Plan Example

How To Sell A Distressed Property In Knoxville Distressed Property Home House Styles

First Approval For New Knoxville Ballpark Ballpark Digest

Airbnb Will Start Collecting Lodging Tax In Knoxville Tennessee